We're hiring! Discover our culture and explore open roles.

How the Market Maker Efficient Frontier Leverages Kaiko Data for Client Reporting

THE PROBLEM

Historical cryptocurrency data is hard to access: most exchanges do not provide extensive history via their API, and few data providers have comprehensive or high-quality coverage. This posed a challenge for the market maker Efficient Frontier, who needed granular liquidity data for client reporting on the impact of their services.

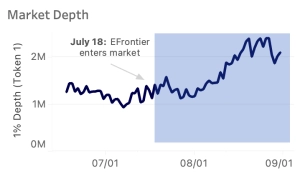

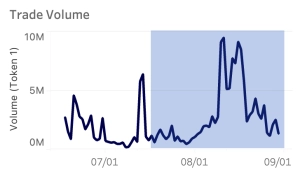

Specifically, they needed to demonstrate that the liquidity they provided for tokens caused an increase in volume and depth.

THE solution

Using Kaiko’s Level 1 and Level 2 Data for sourcing historical trade and order book information, Efficient Frontier is now able to produce regular reports demonstrating the impact of their market making services for their clients. They were able to show that they generated significantly more volume on several crypto exchanges for the crypto tokens they provide services for.

Market depth increased nearly 2x after Efficient Frontier began market making for [TOKEN 1] on Binance and trade volume increased 23% and 43% for the [TOKEN 1]-BUSD and [TOKEN 1]-BTC trading pairs.

With their Level 2 Aggregations subscription tier, they can monitor and report on their services to their clients more efficiently. Specifically, this tier provides aggregated order book data, which is one of the only services in the industry enabling simple monitoring of historical and live liquidity, without the hassle of having to manage massive snapshots and tick-level order book data feeds.

Ready to Get Started?

We serve 200+ enterprise clients worldwide, from financial institutions to crypto-native enterprises. Learn how you can benefit from Kaiko today.