New Kaiko Exchange Ranking Report

Kaiko Market Explorer.

Explore market dynamics of assets and exchanges, including trading volumes, market depth, token metrics, and both on-chain and off-chain transaction data.

Super-Charge Your Liquidity Analysis

Traders, exchanges, and institutions use Kaiko Market Explorer for market research, monitoring, and business intelligence, gaining a comprehensive overview of crypto market activity

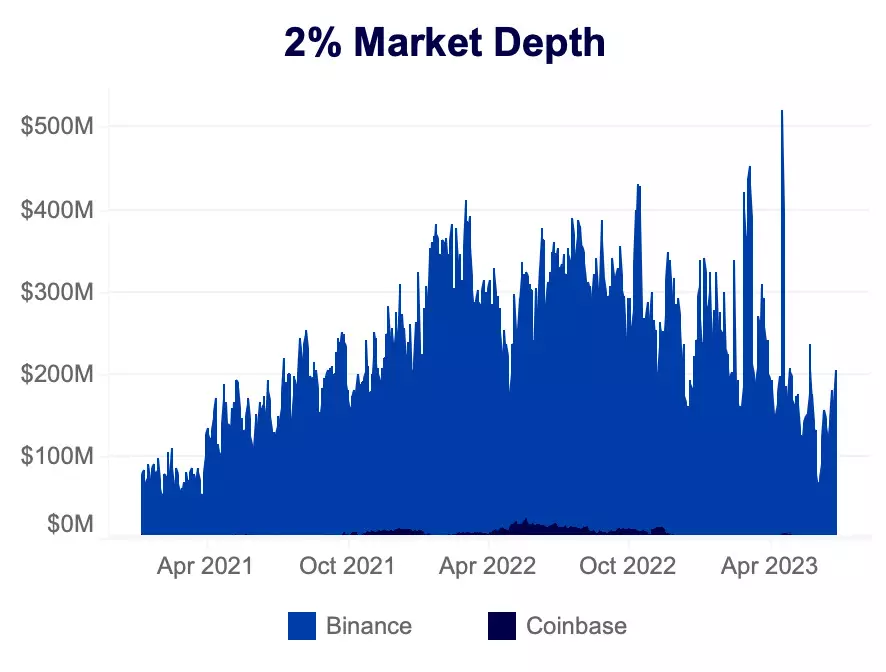

Monitor Market Depth

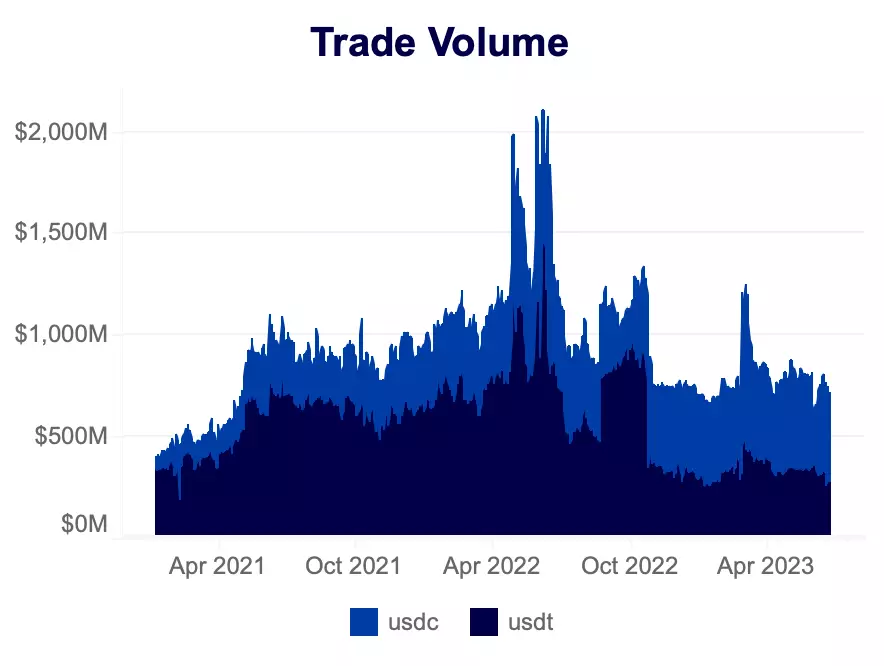

Compare Asset Volumes