We're hiring! Discover our culture and explore open roles.

A Decade of Data: Celebrating Kaiko’s 10 Year Anniversary.

july 17th 2024

This year, Kaiko celebrates its 10th anniversary, a decade of data collection and distribution marked by extraordinary changes in the crypto industry.

Throughout the sector’s evolution, Kaiko has been a trusted partner to corporations and institutions, as well as native blockchain applications, helping them navigate these complex markets. Our data has accompanied the introduction of derivatives markets and ETFs, regulated exchanges, institutional DeFi, advanced derivatives, tokenization, and among others, stablecoins. Yet still, there is so much more innovation to come.

Through the ups and downs, we have embodied the model of patient growth, steadily scaling our operations while avoiding the pitfalls of rapid expansion and wasted capital. This approach has ensured we’ve never wavered from our mission: providing trusted information, from all markets, on all networks.

Today, industry leaders including Société Générale, S&P, Fidelity, CBOE Digital, Bitstamp, Chainlink, Gemini, alongside major US and European regulators, leverage our data solutions to power financial products, or conduct risk and treasury management.

As we celebrate our milestone anniversary, we’re reflecting on our journey from founding to scaling, and looking forward to what the future holds.

the beginning

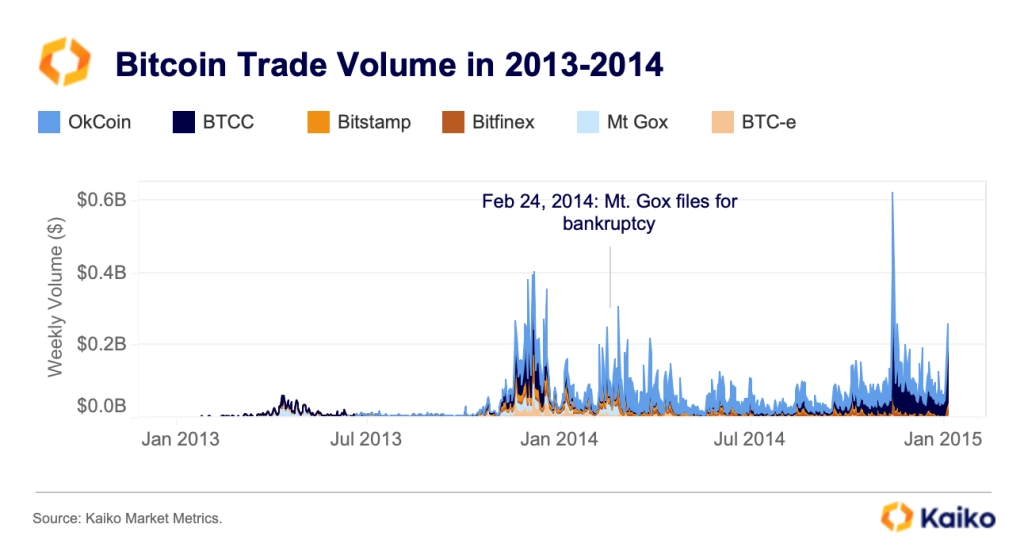

In 2013, before Kaiko was officially founded, we started collecting historical trade data from several early crypto exchanges, including BTCC (2011), Bitstamp (2011), BTC-e (2012), Bitfinex (2012), Local Bitcoin (2013), OkCoin (2013) and Mt Gox (2010). At the time, these exchanges only listed one asset, Bitcoin, and served the majority of the retail market. However, it was also at this time that Mt Gox suffered the industry’s first major exploit, leading to Bitcoin’s first crypto market crash and causing the BTC/USD price to drop from $967 to $224.

This period coincided with a wave of new traders, which eventually led to increasing sophistication and higher demand for crypto data. However, this data was scattered, of poor quality, and hard to access.

In 2014, Kaiko officially launched to solve crypto’s data problem, addressing the data quality issues in a fragmented, opaque, retail and unstructured crypto industry.

Why Kaiko, you may ask?

Kaiko shares its name with the submarine probe that traveled to the deepest point of the Mariana Trenches, bringing to the surface troves of data that influenced oceanographic research for years.

In the same way, we were the first company to take on the quest to provide reliable and accurate data to crypto investors, bringing efficiency and transparency to this nascent industry.

We understood the powerful effect that data could have on transforming these markets into a professional and credible investable asset class.

SCALING UP

In 2017, institutions started taking a more serious interest in crypto, fueled by the ICO boom. At that time, Kaiko’s purpose was to bridge traditional and blockchain ecosystems, by providing reliable and actionable data and services.

In its early days, Kaiko introduced its data offering to meet the crypto industry’s urgent needs. This data enabled numerous vital use cases, such as strategy backtesting, advanced valuation models, and thorough market analysis.

Notably, it facilitated the detection of market abuse (Eitan Galam, 2017) and the discovery of arbitrage opportunities (Antoinette Schoar, MIT, 2018) across exchanges. These features promoted a more transparent and efficient market while contributing to impactful industry findings, strengthening Kaiko’s reputation as a reliable data partner.

Highlights from our scaling era

Starting to scale

- January 2018: We grow our business and engineering teams to develop our enterprise offering

- September 2018: We release our market data API, designed for seamless access to trade and order book data

- December 2018: We expand our coverage to over 80 crypto exchanges

- September 2019: We close a $5M seed round from investors Anthemis and Point Nine Capital, to scale our engineering team and data infrastructure

International expansion, and launch of new product lines

- November 2019: We launched our US C Corp subsidiary, Kaiko Inc., and opened a NYC office to start our global expansion

- March 2020: We develop our first research product, powered by Kaiko data

- May 2021: We launch our advanced real-time streaming data service, designed for enterprise integrations

- June 2021: We close a $24M series A to supercharge our hiring and the expansion of our product suite, led by Underscore, Anthemis, and Alven

- November 2021: We release our first DEX data product as DeFi takes off

- March 2022: We create our Singapore entity, Kaiko Pte, and open our Singapore office

- April 2022: We create our UK entity, Kaiko Ldt. and open our London office

M&A, external growth, successful integration of two companies and consolidation

- April 2022: We acquire Kesitys, a provider of quantitative decision tools for risk optimization. This acquisition enabled us to create a complete suite of metrics derived from Kaiko’s original datasets to assist traders with investment decisions and risk management.

- June 2022: We acquire Napoléon Indices from Coinshares, and launch Kaiko Indices to support the growth of institutional exchange-traded products and derivatives with regulated benchmarks and indices. In addition, we obtained approval from the French Financial Markets Authority (AMF) to launch Kaiko Indices and administer benchmarks under the EU Benchmark Regulation (BMR).

Entering a growth phase

- June 2022: We raise a $53M Series B led by Eight Roads, to cement our status as the industry leader in crypto information.

By June 2022, we are a trusted information and connectivity services provider, with 200+ enterprise clients and operations around the globe.

TODAY

We are proud to have come a long way since our creation in 2014, and this year marks the achievement of significant milestones in our journey:

- Our crypto benchmarks settled over $2 billion on derivatives exchanges in Q1, and this keeps growing as the ecosystem increasingly relies on Kaiko benchmarks for trading, settlement, and clearing;

- We have established a truly global follow-the-sun operation, with full-fledged entities and operations in the US, France, UK, Singapore, and Hong Kong;

- We serve 200+ clients, ranging from Circle and S&P to Bitstamp and CBOE Digital;

- We have successfully completed two strategic acquisitions and fully integrated the teams and products into Kaiko;

- We offer the widest range of data delivery channels for enterprises, including via Bloomberg, Deutsche Boerse, Refinitiv, and Oracles, ensuring seamless access to our data and services;

- We meet our client’s technical architecture with support of AWS, Google Cloud & Big Query, Azure and Snowflake cloud services, but also On-premises via ICE, BT and IPC connectivity to our SDK enabled gRPC streaming services;

- We are stepping into custom on-chain regulated data feeds for financial institutions, more on that to come soon!

Navigating Regulation and institutionalization

As the crypto industry matures, we find ourselves in a pivotal moment with the implementation of new regulations such as MiCA, FASB tax requirements, and various country-specific rules. Businesses now have a regulatory obligation to leverage high-quality data to stay compliant and ensure high-quality service to their customers.

Over the past year, we have risen to the challenge by offering more tailored data packages for compliance, designed for both businesses and regulators. These packages cover IFRS and GAAP compliant prices, crypto-specific market abuse detection in line with MiCA, and much more.

To make this massive data easier to access and consume, we have also invested in data visualization, comprehensive SDKs, and AI, further enhancing our clients’ ability to leverage our data for their specific needs.

Looking Ahead: Our Vision for the future of the market data industry

As we look ahead, our vision is clear: to continue serving as the unparalleled bridge between traditional financial market data expertise and a comprehensive understanding of blockchain data and infrastructure. Our unique ability to navigate both worlds with ease sets us apart:

- Read: We efficiently consume, sort, clean, and analyze real time low latency data feeds provided by crypto currency exchanges, as well as run blockchain nodes and extract and contextualize events.

- Write: We deliver data through traditional financial pipelines, real-time low latency streaming systems, and directly into blockchains and smart contracts, where we provide oracle services.

This unparalleled positioning sets us apart. As a global company regulated by the European Markets Authority, audited by a Big 4 firm, and with offices strategically located across the globe, we are uniquely positioned to support the institutionalization and standardization of the crypto industry.

Continued Growth of Crypto as an Asset Class

With recent regulatory developments and financial product offerings facilitating access to crypto currencies for institutional investors, the industry’s needs have expanded and are expected to grow even further. This will create more diverse passive investment opportunities, enabling greater exposure to crypto assets through reliable and regulated methods.

Data will enable and power this expansion through the development of new indices that will create even more opportunities for investors to profit from this innovative asset class.

The growth of the crypto assets industry also prompts a need for robust and tailored risk management solutions. To navigate this, Kaiko’s distinguished quantitative research team has developed cutting-edge tools and processes specifically designed to address the unique risk profile of crypto assets; this ensures our clients have the most advanced resources to confidently assess their exposures and make informed investment decisions.

Genesis of On-Chain TradFi Execution

While the next decade seems to be focused on crypto as a new asset class, the future also beckons for asset and contract tokenization, essentially the “blockchainization of traditional finance”. This means using the automatic seamless 24/7 global blockchain infrastructure to serve as an execution, computation and settlement platform for traditional financial applications.

Kaiko stands out as the only market data provider that bridges traditional and blockchain infrastructures for market data purposes. We’ve developed an inverted data infrastructure that’s capable of gathering and disseminating both on-chain and off-chain data, across both on-chain and off-chain platforms.

Market data will be the cornerstone of the decentralized finance industry by being not just the reference point but also the catalyst for smart contracts to trigger execution and settlement on-chain, in an automated and disintermediated way.

In an increasingly automated and decentralized landscape, the access to reliable, accountable, and regulated market data becomes paramount. Kaiko ensures:

- Accuracy: Data integrity is critical for trust and security.

- Accountability: We provide a transparent audit trail for all data.

- Regulation: We adhere to the highest regulatory standards.

- Connectivity: We provide data to blockchain-based tokenized financial instruments.

A Limitless Market Awaits

With the traditional financial market data industry sized at $42 billion, our addressable market expands exponentially from crypto to TradFi. Kaiko has the potential to provide market data for all on-chain contracts referencing traditional assets, potentially exceeding $100 trillion in size.

Celebrating our 10-year anniversary and looking ahead, the future is bright for Kaiko as we continue to prioritize data integrity and regulatory compliance. By bridging the gap between traditional finance and blockchain, we will play a crucial role in shaping the next generation of financial markets with accurate, accountable, and regulated market data.

Here’s to another decade of success!

Ambre Soubiran,

Kaiko CEO