Updated for Q1 2025: Kaiko Spot Exchange Ranking

Kaiko for Regulatory Oversight

DIGITAL ASSET MARKET SURVEILLANCE – ENSURE CRYPTO MARKET INTEGRITY

We help regulators effectively monitor, detect, and prevent market abuse to uphold their licensing regime, enforce compliance, and maintain crypto market integrity.

-

Market Oversight and Surveillance

Monitor trading activity across 100+ centralized and decentralized exchanges. -

Examination and Enforcement

Identify potential market manipulation, insider trading, and other illicit activities. -

Stablecoin Analysis

Gain insights into the usage and trading activity of the largest stablecoins.

How we help you

With extensive CeFi and DeFi data powering a comprehensive platform delivering a full market view, regulators can effectively identify signs of market manipulation, insider trading, and other illicit activities to justify further investigation.

Overcome the false positive efficiency crunch

Maintaining crypto market abuse regulations at scale can be difficult unless the right trade surveillance systems and data are in place to differentiate between a harmless anomaly, and a genuine threat. With false positives weighing heavily on enforcement teams and creating a scaling efficiency challenge, regulators turn to us to reduce the burden and improve their confidence in the alerts they receive.

Eliminate data compatibility challenges

With multiple data sources powering digital asset compliance platforms, consistency and ease of integration are critical components to the overall efficiency and success of a compliance enforcement strategy. Ongoing normalized and reliable real-time data feeds are essential to any effective compliance tech stack in the 24/7 crypto market, and that’s what we consistently deliver, across the CeFi and DeFi landscape.

Spotlight market abuse in CeFi & DeFi

Visibility is the key to identifying potential signs of market abuse and so regulators need to be sure they have the necessary data to identify genuine anomalies and maintain crypto market integrity in DeFi and CeFi ecosystems. Our comprehensive and flexible solution empowers regulators in their crypto market manipulation detection efforts, by providing complete visibility where it really matters, regardless of ecosystem.

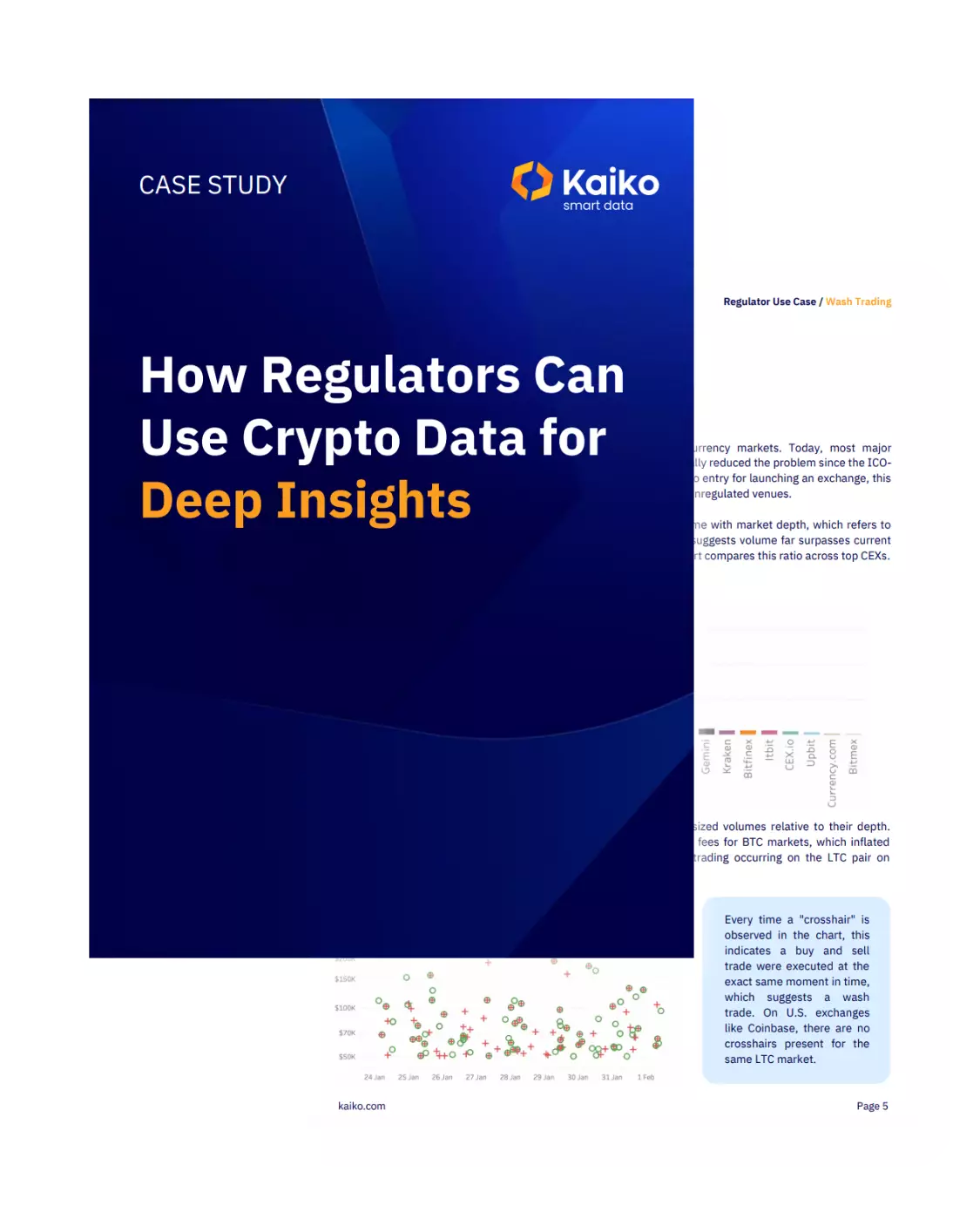

Case Study

How Regulators Can Use Crypto Data for Deep Insights

Centralized exchanges may be the last haven of crypto anonymity, but it is still possible to gain insights into market activity. This case study explores how regulators can identify bad behavior, ensuring greater market integrity.

Solution

Monitor, detect, and prevent market abuse with Kaiko Market Surveyor

Ensure crypto market integrity with automated trade surveillance, monitoring, and alerts. Detect potential market abuse as it happens across CeFi and DeFi ecosystems with comprehensive, real-time digital asset data to maintain your regulatory regime.

Want to speak to an expert?

Learn more about how Kaiko can help you detect market abuse in real-time and maintain your compliance regime.