Updated for Q1 2025: Kaiko Spot Exchange Ranking

Welcome to the index in focus!

Welcome to the Index in Focus! In this week’s edition, we looked at the relationship between Bitcoin and Gold, and how to track the combined outcome of both assets using the BOLD index. As Gold reaches fresh all-time highs and Bitcoin falters, the dual strategy offers optimal risk-adjusted returns. In the report, we explore:

-

The Digital Gold narrative.

-

Bitcoin as a so-called safe haven asset.

-

Optimal risk-adjusted returns.

Introduction

The digital asset space is full of narratives with varying levels of success. To date, the most successful one has been Bitcoin’s “Digital Gold” moniker. Digital Gold is easy and digestible, and a large swathe of investors can understand it.

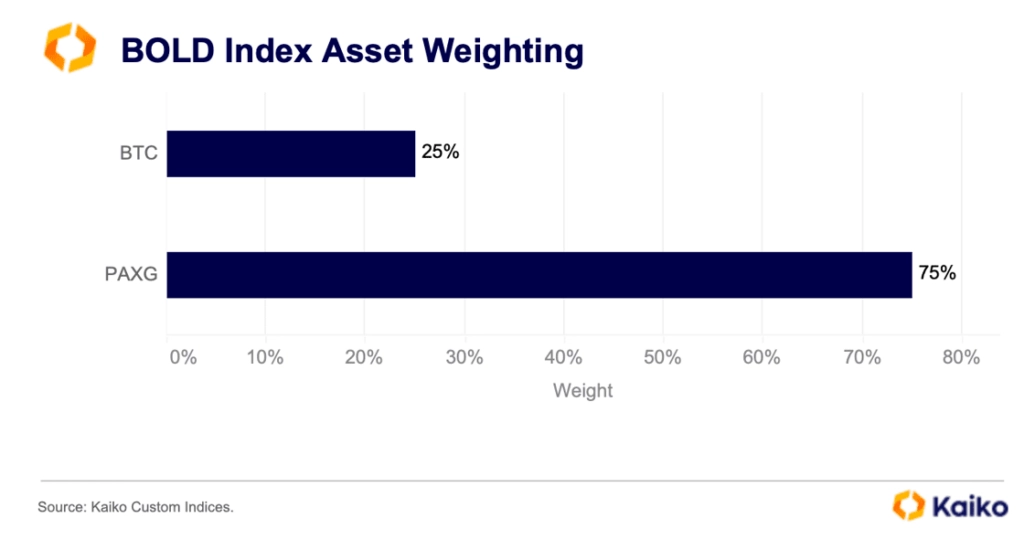

Bitcoin exhibits many similarities with Gold, most notably its scarcity. Just as Gold is a finite resource, the supply of Bitcoin will never exceed 21 million. It’s these comparisons, as well as the argument for Bitcoin to act as a hedge against inflation, that led to the creation of the BOLD index—which powers the first-ever Bitcoin and Gold exchange-traded product.

But more than just the structural similarities, the two assets also offer market-beating returns. Over the past year, Bitcoin and Gold have consecutively set record highs. However, Gold’s returns are often more consistent.

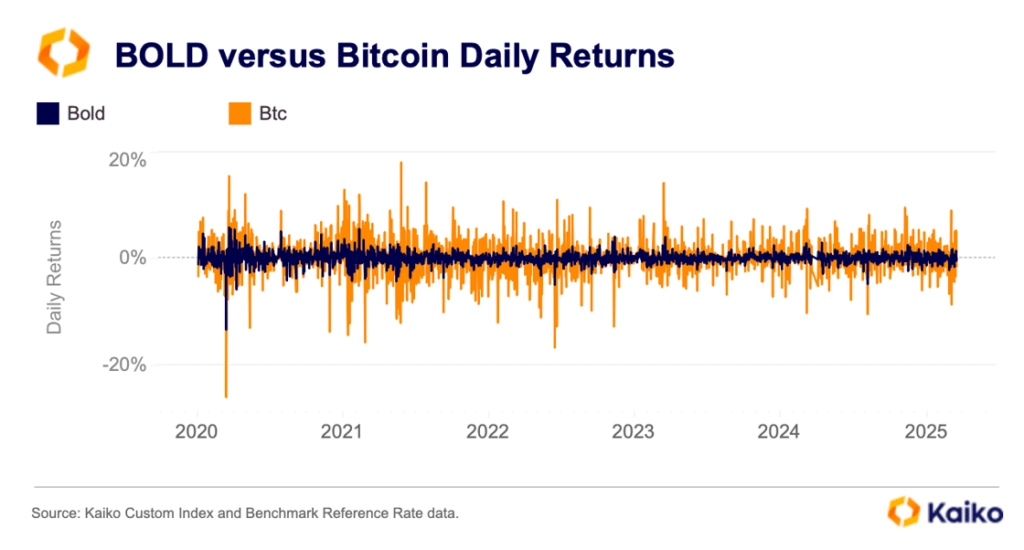

Where Bitcoin might rise 20% in a week, it can also fall by the same amount the next week. Gold is less prone to extreme moves. As such, combining the two assets offers exposure to large returns within a more consistent range.

Despite Bitcoin and Gold purporting to offer protection against inflation, their correlation is often quite low.

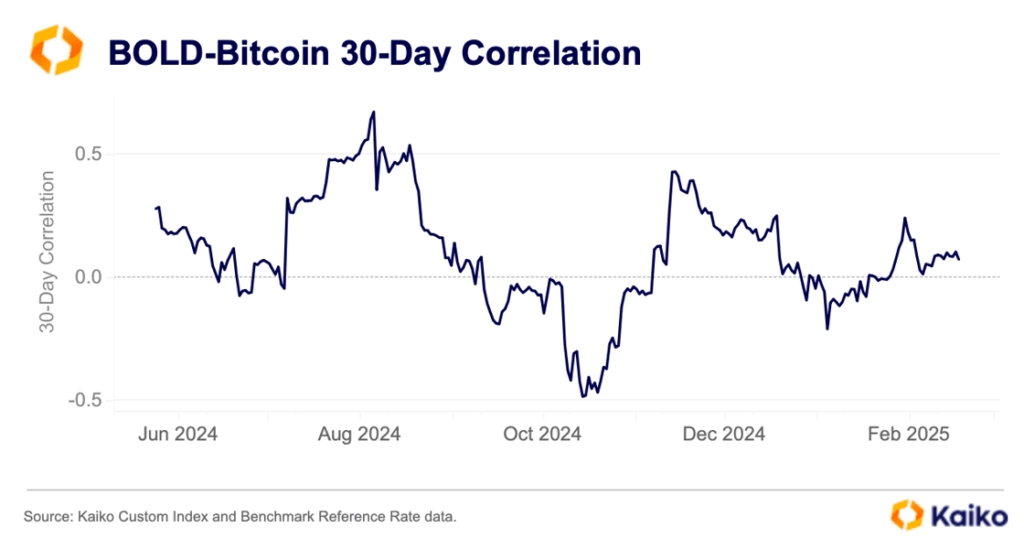

While Bitcoin can exhibit high correlation to Gold, and even equities, it’s usually for brief periods. These periods of heightened correlation tend to coincide with broad market shifts and changes in broader market liquidity conditions.

The rolling 30-day correlation between the two assets hasn’t been above 0.67 in the past year. The assets are often negatively correlated, with the correlation sinking to -0.48 following the U.S. election in November.

Over the long-run the relationship between returns is insignificant.

Read the full report on BOLD now!