Updated for Q1 2025: Kaiko Spot Exchange Ranking

Welcome to the index in focus!

Welcome to the Index in Focus! This week, we’re analyzing the Kaiko 10 Index (KT10), part of our multi-asset Blue Chip indices. With a compound annual growth rate of nearly 60% since inception, the index offers competitive returns that capture the broader markets performance without sacrificing. In this report, we explore:

-

Index design and returns

-

Individual catalysts drive returns

-

Outperforming benchmarks

Introduction

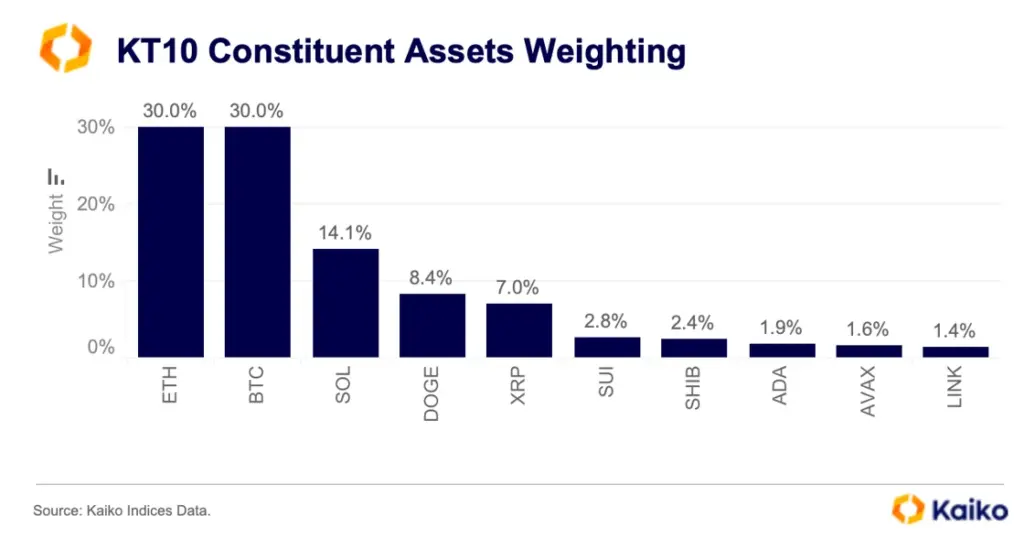

The Kaiko 10 Index (KT10) consists of ten digital assets, selected based on size and liquidity. While other broad-based indices are built based on market cap alone our process factors in liquidity on centralized platforms. Crucially this allows us to know how tradable these assets are, how quickly positions can be converted into cash, and how much rebalancing costs will be incurred.

The index includes assets from Layer-1s to memecoins and utility tokens. BTC and ETH are the largests assets by weight, but don’t always account the lions share of returns.

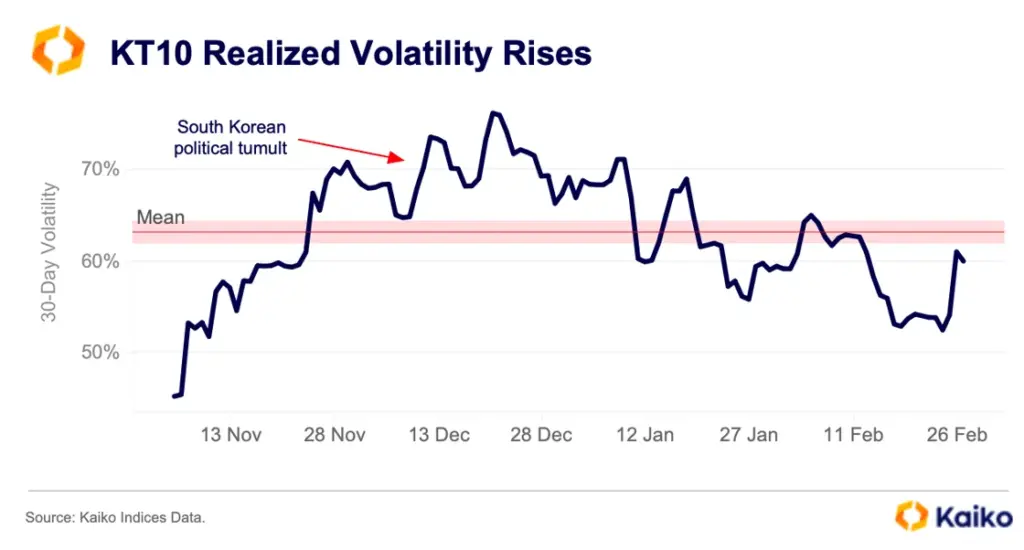

The KT10 has achieved impressive returns. The index has maintained a compound annual growth rate of nearly 60% since inception. While returns have also become more consistent, with less extreme outliers, there has been an uptick in volatility in the recent past.

The changing administration in the U.S., and a short lived martial law imposition in South Korea at the beginning of December contributed to this increase. The KT10’s mean rolling 30-day volatility has risen to 63%, from 52% prior to November.

Universe of investAble products

While important factors for most, returns and political tailwinds aren’t enough for all market participants. Crypto is a global asset trading 24 hours a day, as a result, investors need access to a range of instruments trading across multiple venues around the world.

The demand for derivatives and spot products on assets, as well as structured products, is only going to grow. These products enable market participants to effectively trade and implement increasingly complex strategies as digital assets mature similarly to traditional markets—moving from vanilla products into more exotic products.

Undoubtedly BTC has been the major winner, but more assets are beginning to see progress. In fact, every single asset in the KT10 has at least one regulated product tied to it.

Learn more about these catalysts and explore the full report below.