Updated for Q1 2025: Kaiko Spot Exchange Ranking

The case for crypto momentum investing.

VHASHMOM | Kaiko Custom Indices

Written by Adam Morgan McCarthy and Dessislava Ianeva- Aubert

Welcome to the index in focus!

Welcome to the Index in Focus! In this week’s edition we’re focusing on momentum strategies, looking at how investors can capitalize on rising prices. While pioneered in traditional markets, momentum strategies are particularly relevant to digital assets. In the report, we explore:

-

The VHASHMOM index design.

-

Benefits of capping weights in the index

-

The strategy’s risk-adjusted returns.

Introduction

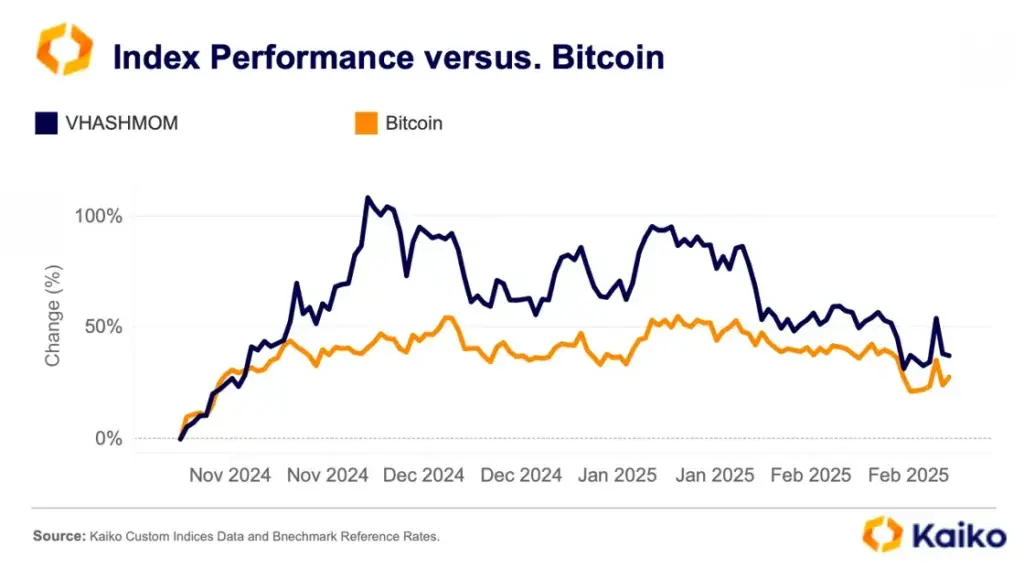

The index has significantly outperformed Bitcoin since 2021 registering both higher compounded annual growth rate and cumulative returns.

It effectively captured the upside momentum during the 2021/2022 bull run and more recently the post-election rally driven by regulatory clarity and U.S.-centric narratives. This outperformance also underscores the benefits of capturing smart beta by optimizing indices with factors.

The changing administration in the U.S., and a short-lived martial law imposition in South Korea at the beginning of December contributed to this increase. The KT10’s mean rolling 30-day volatility has risen to 63%, from 52% prior to November.

In 2025, crypto-specific narratives, such as growing institutional adoption and a friendlier regulatory environment, could provide tailwinds for crypto momentum strategies, even as equity momentum shows signs of exhaustion.

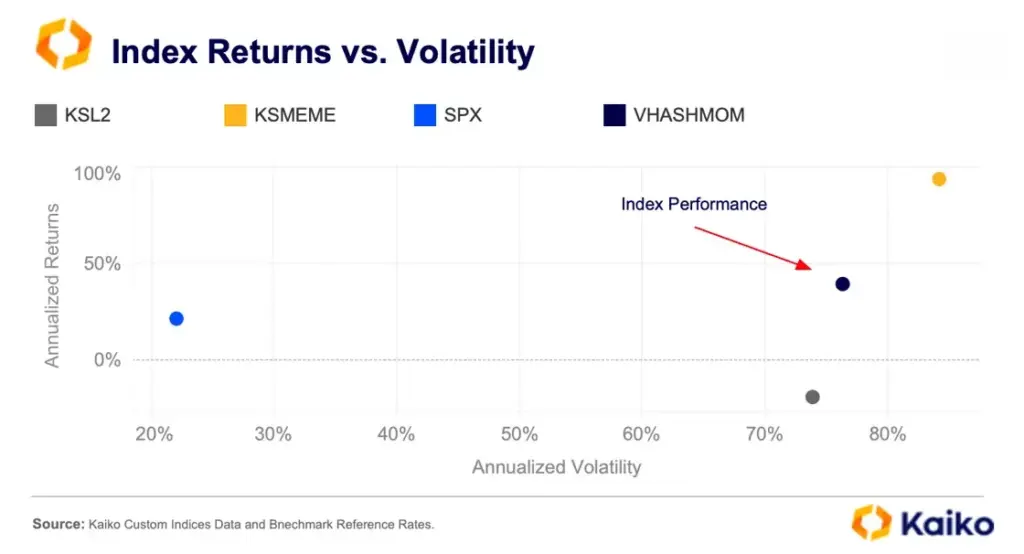

The index also offers competitive risk-adjusted returns. VHASHMOM’s annualized returns since inception are nearly 40%. This places the index well above other digital assets in terms of returns. It even outperforms broad-based equity indices, such as the S&P 500.

However, despite offering competitive returns these do come at a cost, with annualized volatility above 75%. Only the Kaiko Meme index (KSMEME) has higher volatility since inception, while the Kaiko Layer-2 index (KSL2), which underperformed the market, comes close with 74%.

Volatility is more of a feature than a bug in crypto markets and as such we find it useful to consider broader risk metrics when evaluating the performance of an index.