Just Announced: Kaiko Acquires Vinter, Europe’s Leading Index Provider

The crypto industry’s leading liquidity data is now at your fingertips.

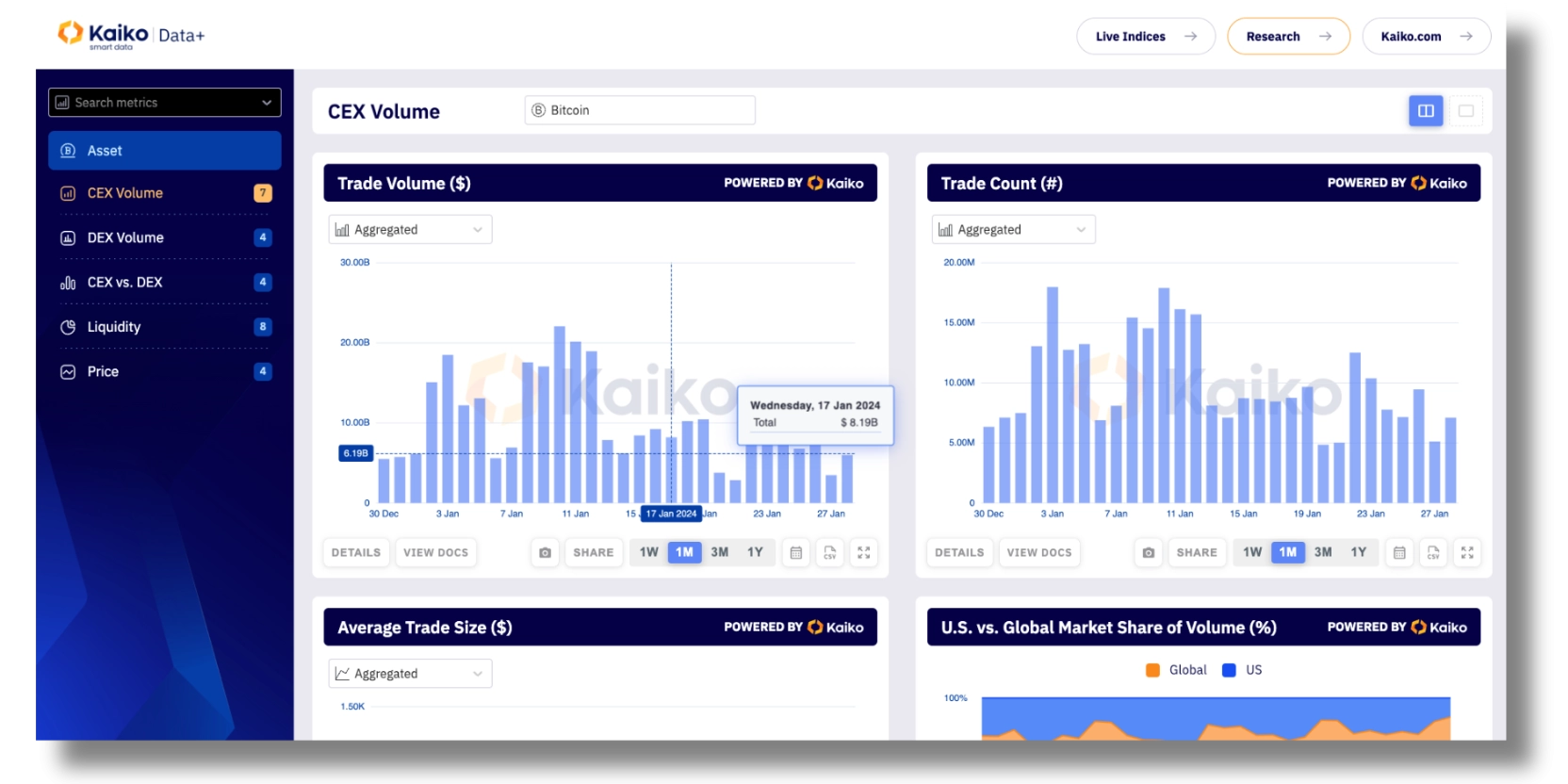

We are pleased to announce the launch of Data+, a simple yet powerful data visualization platform designed for deep market insights. Data+ enables any analyst to explore crypto trade and order book data with unparalleled precision.

Key features include:

25+ charts powered by Kaiko’s trade and order book data

Comprehensive coverage of BTC/ETH

Dozens of CEXs and DEXs

Up to 1 year of historical data

Customize charts with data from the exchanges you care about

What’s included?

Data+ gives you the tools to create your own insights. Build and analyze charts with a seamless set of features:

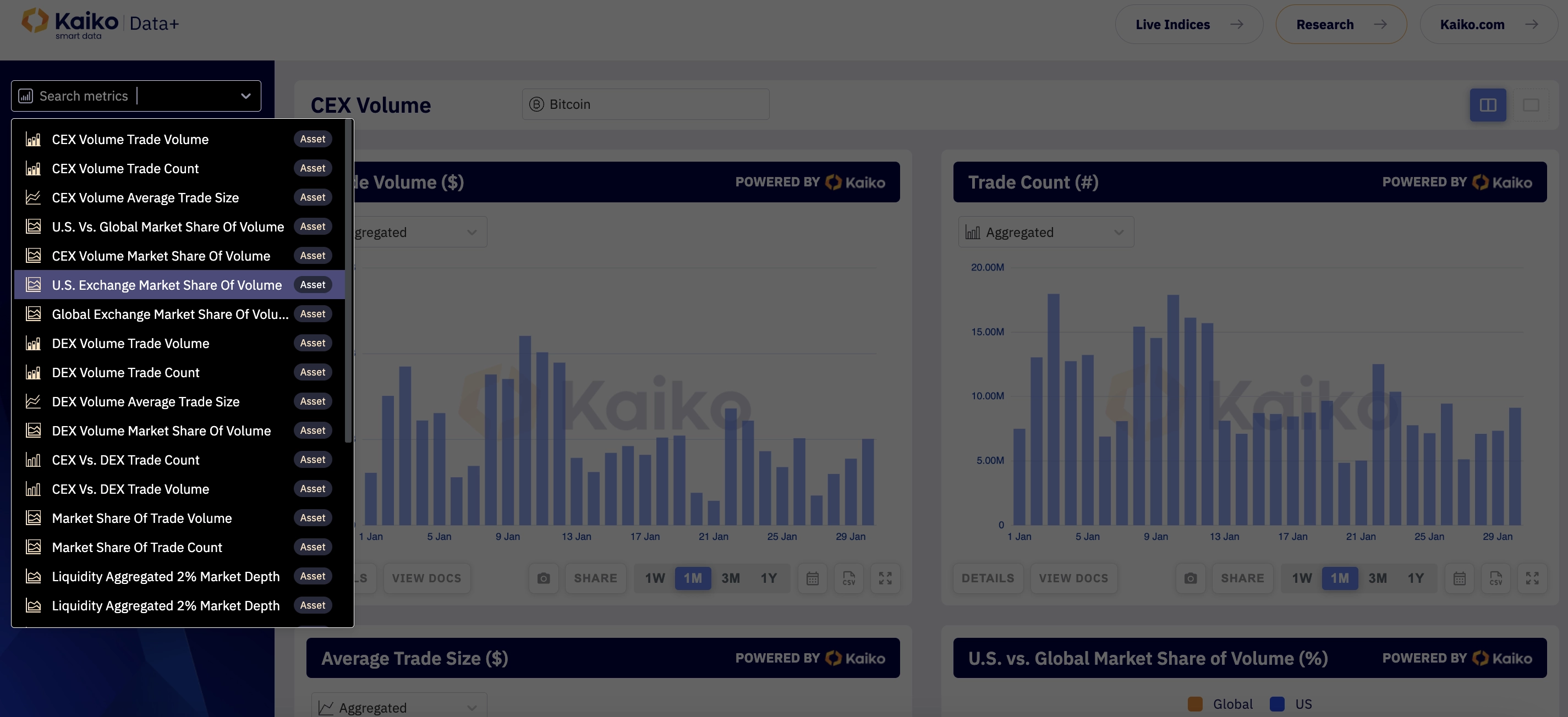

Access unique data such as average trade size, market depth, trade volume, and market share

Toggle between aggregated and granular views

Download or embed charts into your research

Customize timeframes (1y, 3m, 1m, 1w)

Include or exclude specific exchanges in your data visualization

Implement asset filters, and more.

WHO IS IT FOR?

Data+ is designed for professionals who require in-depth liquidity insights for crypto assets. Whether you are an experienced trader, financial analyst, portfolio manager, or researcher, Data+ caters to your need for advanced tools and granular data with a simple interface.

What Types of Analysis?

With Data+, you can explore an asset’s market structure at a high-level or at the exchange-level, looking at trades, order books and price data. The customization features let you pick and choose which exchange sources you want.

Try it out below 👇

Which Data Types?

Data+ is powered by Asset Metrics, the ultimate data product for analyzing crypto liquidity. Asset Metrics aggregates trade and order book data across all instruments and exchanges in our coverage.

Data+ includes 25+ charts featuring trade and order book data for a crypto asset, with a view into any centralized or decentralized exchange.

Key charts include:

Trade Volume

Trade Count

Market Share of Volume

Market Depth

Bid vs. Ask Depth

U.S. vs. Global Exchange Depth

Realized Volatility

YTD Returns

And more…

Never Miss An Update

Get inspiration from our research team for your own analysis.

MORE FROM KAIKO

![]()

Product

New York

SEC Approves First Cross-Asset ETF Combining Bitcoin and Carbon Credits

The US Securities and Exchange Commission has approved the 19b-4 filing for 7RCC Spot Bitcoin and Carbon Credit Futures exchange-traded fund. Vinter, now part of Kaiko is proud to work with 7RCC as the benchmark provider for this new investment innov...

20/11/2024

Read More![]()

Company

New York

Kaiko Acquires Vinter, Europe’s Largest Index Provider for ETP Issuers

Kaiko has acquired Vinter, Europe’s largest crypto index provider. This strategic acquisition strengthens Kaiko’s position as the global leader in crypto market data and indices, expanding our indexing capabilities. Vinter’s expertise in serving asse...

12/11/2024

Read More![]()

Company

New York

The Importance of Independence Amidst Crypto Industry Consolidation

The growing adoption of exchange-traded products (ETPs/ETFs) brings exchanges the incentive to become key sources for index constituents. But when exchanges also own index and data providers, conflicts of interest arise.

15/10/2024

Read More