Updated for Q1 2025: Kaiko Spot Exchange Ranking

Kaiko x Moodys: Spot Crypto ETFs Draw Institutional Interest, Despite Risks

A collaborative research report powered by Kaiko data.

May 1st, 2024

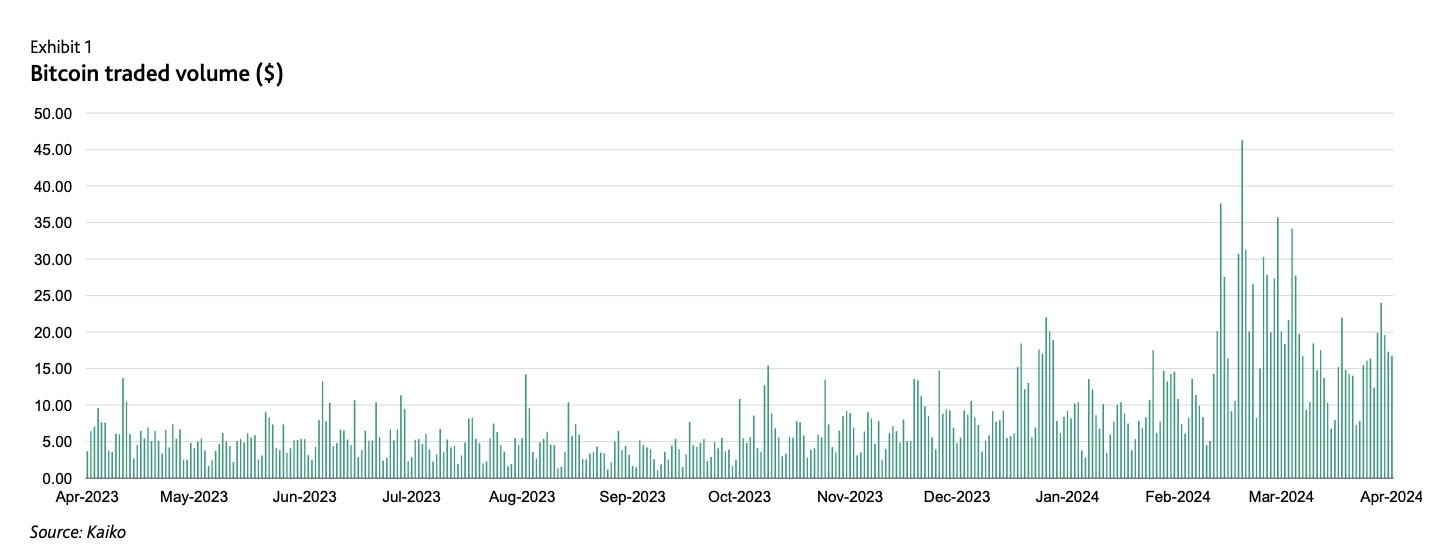

Volumes of spot ETF trading have surged globally since the launch of ETFs. Since 11 January, Bitcoin trade volume has hit multiple new multiyear highs, at one point topping $46 billion.

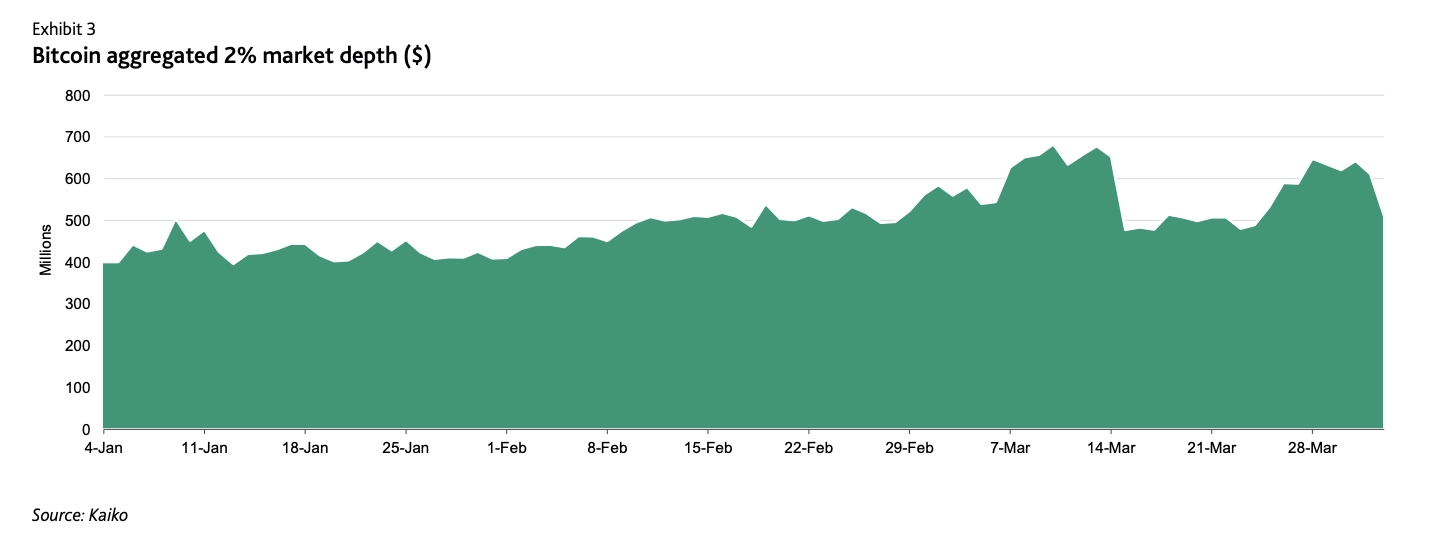

Bitcoin liquidity has increased since the launch of spot ETFs. Since January, as measured by market depth – the quantity of bids and asks on an order book – Bitcoin market depth has surged from approximately $400 million to roughly $500 million across all exchanges.

ETFs can amplify market downturns. If there is an event that triggers large outflows, ETF issuers will need to liquidate their holdings, which could weaken values in crypto markets.

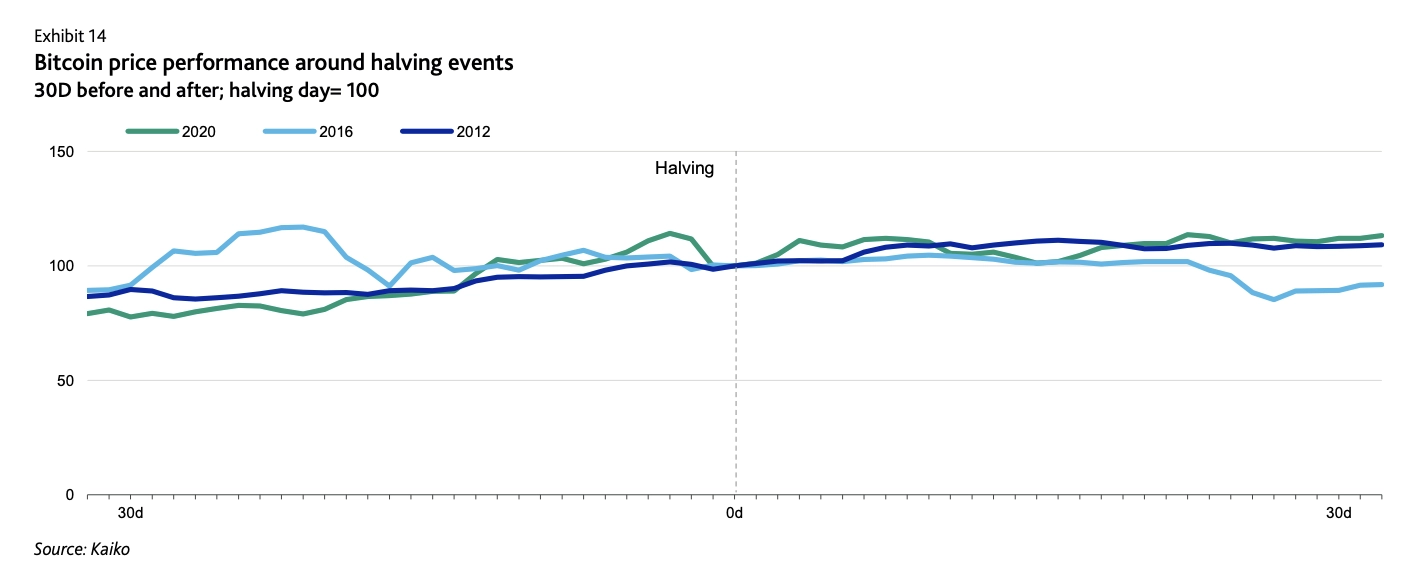

Bitcoin’s halving will likely be positive for its price, if spot ETF inflows remain strong. The launch of the spot ETFs has created a sharp reduction in Bitcoin’s supply. Should ETFs continue to generate large inflows, there will be a bullish impact on Bitcoin’s price posthalving.

Download the full report here and visit Moody’s website here.

Never Miss An Update

MORE FROM KAIKO

![]()

Partnerships

New York

Kaiko Indices Selected as the Reference Rate Provider for One Trading’s MiFID II-Regulated Perpetual Futures

Kaiko Indices is pleased to announce our partnership to provide reference rates to support the launch of One Trading’s new MiFID II-regulated perpetual futures platform.

25/04/2025

Read More![]()

Perspectives

New York

Meme Coins: A Market Phenomenon or an Investable Asset Class?

Our latest survey reveals a sharp divide on meme coins’ place in the investable crypto universe, with perspectives varying across industries. Explore the key findings.

04/03/2025

Read More![]()

Perspectives

Paris

Bybit Hack: The importance of scalable blockchain analytics solutions

Learn more about how an interface-free approach can improve the efficiency and flexibility of your investigations.

25/02/2025

Read More