Kaiko Research: The crypto industry’s leading data-driven research, delivered weekly.

Welcome to the index in focus!

Welcome to the Index in Focus! In this week’s report we discuss a hot topic from the recent Exchange ETF conference in Las Vegas: options-based indices. Our report focuses on covered call indices and the mechanics behind these strategies.

-

101 on BTC covered call indices

-

BTC covered call indices outperform spot BTC

-

Lower volatility for better returns

Introduction

Asset managers in the U.S. have spent the past two years vying to launch crypto-related products, namely spot exchange-traded funds. However, there is a growing segment of the market taking a different approach.

Options-based strategies are becoming increasingly popular as market participants seek more advanced ways to offer exposure to digital assets. In this week’s report, we’ll explore this boom and take a closer look at covered call indices in particular.

On-the-ground insights

The launch of BTC and ETH ETFs in the U.S. last year signaled a shift from the fringes toward the mainstream. Digital assets are no longer taboo, as some of the largest asset managers in the world jostle for market share in this burgeoning space. This was apparent in March, when I, alongside the Kaiko Indices team, attended the Exchange ETF conference in Las Vegas.

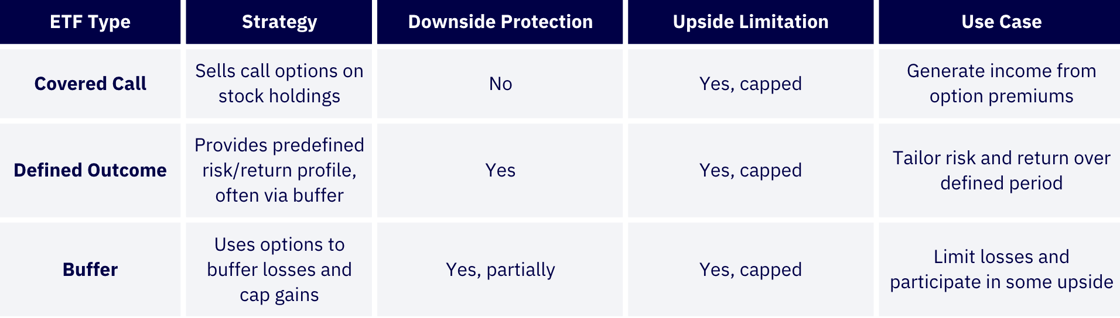

Options-based strategies were among the most talked-about topics at Exchange this year, as issuers look to bring successful products from the traditional space to the digital asset market. These can take several forms; some of the most popular strategies include defined outcome, buffer, and covered call.

In focus: Covered Call Indices

One of the most popular options-based indices gaining traction in crypto markets right now is the covered call. Several asset managers, including Grayscale and Roundhill, have already launched BTC covered call ETFs based on this strategy. Roundhill has accumulated over $170 million in assets under management since inception, showcasing the popularity of these products.

For issuers, these products make a lot of sense—not only because there is strong investor demand (with more than $460 million in assets under management accumulated in just a few months across the four existing U.S. funds), but also because the average management fee is much higher than that of spot ETFs. The typical fee for a covered call ETF in the U.S. is around 90 basis points, compared to about 20 basis points (or even lower) for spot crypto ETFs. So, what do investors gain from paying higher fees?

Covered call strategies allow investors to generate yield while gaining exposure to BTC. The premium earned from selling call options on BTC is reinvested into the index, providing some downside risk mitigation. This feature comes in handy during market lulls, which we’ve seen this year and will discuss in more detail later.

This yield-generating element has led to increased popularity in recent years; however, it does come at a cost for assets such as BTC. During bull runs, covered call strategies have limited upside potential, creating an inherent trade-off for investors: capped long-term growth versus income with lower volatility.

While that trade-off might not impress crypto-first investors this strategy can bring BTC to a broader range of investors. In particular those who want their assets to generate some yield and who aren’t comfortable with BTC’s historical volatility. This benefit is especially relevant now, as the Economic Policy Uncertainty Index has reached a record high in 2025.

Covered Call Index Outperforms Bitcoin

While options-based strategies may seem overwhelming or complex, indices exist that enable investors to replicate such strategies simply. Take the Kaiko Indices custom Bitcoin Covered Call Index (BTCC), for instance. This index tracks the performance of a covered call strategy applied to BTC.

The index is long BTC, holding spot, while simultaneously selling an out-of-the-money call option. Both positions are held in equal amounts (with the notional value of the call option matching the BTC holding). The option is held for one month and rolled over on the last Friday of each month, at which point the index is rebalanced. As mentioned in the previous section, it is assumed that the premiums from selling calls are reinvested into the index.

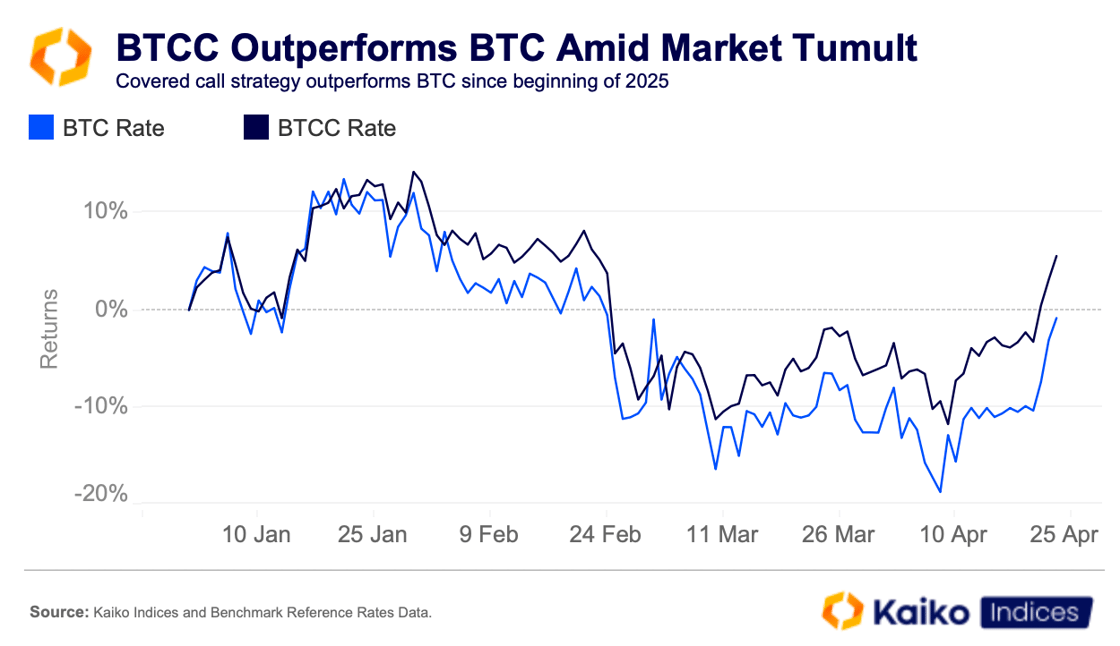

Markets have experienced increased volatility since January, with BTC trading below $80k due to tariff-driven uncertainty. This is where selling call options becomes useful, as the income generated from premiums can provide a certain level of risk mitigation during periods of heightened volatility.

The BTCC index outperformed BTC during this period of market uncertainty, showcasing the value of selling call options in combination with holding spot.

BTCC’s income-generating element was highlighted between March and April, as it outperformed BTC amid a market lull. This outperformance was accentuated while BTC was rangebound between $80k and $85k during this period.

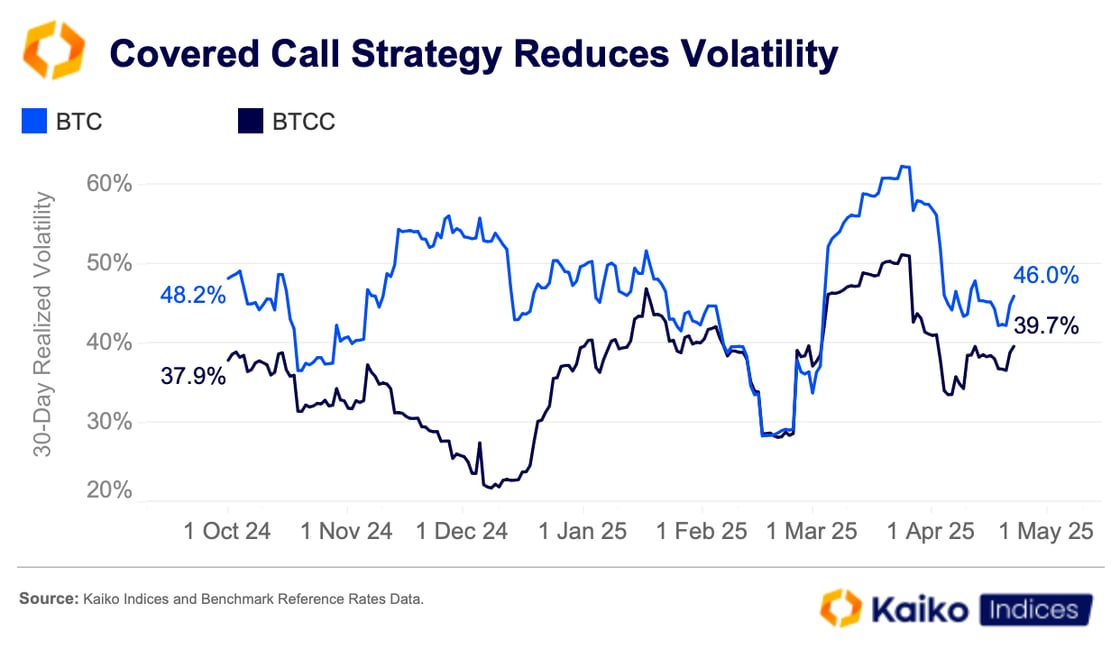

Those returns also come with much lower volatility, with 30-day realized volatility remaining below 50%, while BTC volatility rose above 62%.

Volatility doesn’t tell the whole story, though. It is a useful indicator of the potential presence of risk, but it is not a comprehensive risk metric in and of itself.

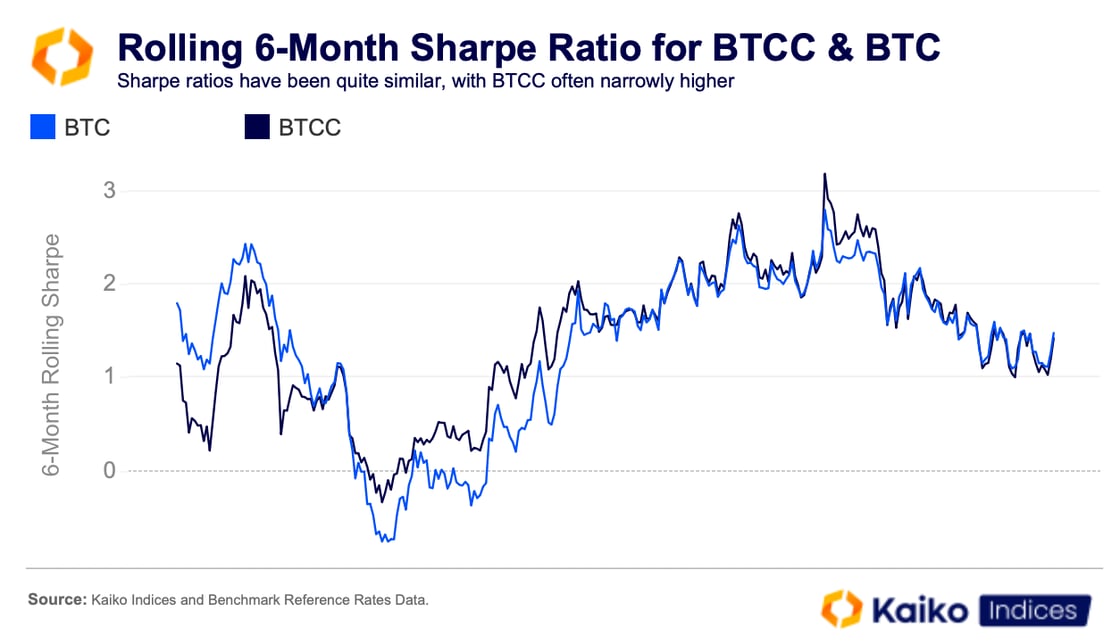

The two strategies have quite similar risk profiles. The rolling 6-month Sharpe ratio’s for both strategies closely track one another over the past year—although BTCC has slightly better risk-adjusted returns over the period.

This slightly improved risk profile is to be expected. The lower volatility acts as a cushion while selling premiums generates consistent yield, benefiting the covered call strategy during periods of volatility in the underling spot market.

Conclusion

Over the long run, this options-based approach to BTC investing offers a comparable risk profile to holding spot BTC, but with the added benefit of reduced month-to-month volatility. In certain market conditions—particularly sideways markets—returns can outperform spot BTC, thanks to the yield generated from selling premiums.

These strategies are generally defensive and aimed at investors seeking income, rather than broad market exposure. As such, they are unlikely to gain widespread adoption in their current form. However, more innovative or exotic options-based strategies are likely to emerge, taking their lead from traditional finance.

This evolution is already taking place in traditional markets, where options-based indices are incorporating zero-day-to-expiry (0DTE) contracts. The introduction of options on BTC ETFs expands the design space for crypto derivatives, paving the way for more flexible strategies. A BTC covered call index that dynamically adjusts its income cap using 0DTE options is just one potential direction this space could take.